Introduction to Data Science in Banking and Finance

Data scientists check into the Future. They start with big data, which is identified by the 3 Vs: speed, variety, and volume. The information is then utilized to feed models and algorithms. Working around machine learning as well as AI, probably the most cutting edge data scientists create designs that instantly self-improve, learning and recognizing from their failures of theirs.

As outlined by a report, the global information science business is actually anticipated to achieve USD $115 billion throughout 2023, having a CAGR of 29 %. Based on a Deloitte Access Economics survey, 76 % of organizations wish to increase their information analytic spending over the following 2 years. Data science in banking and analytics is able to aid almost any business in any sector. Nevertheless, several industries are much better positioned to gain from analytics and data science than others such as data science in banking.

What is Data Science?

Data Science is actually integrative self-discipline of science that uses scientific methods, procedures, algorithms, equipment, strategies, & systems to take out information and knowledge from great quantities of untuned and unstructured data. Data science is actually correlated with printer learning, information mining, and then large data fields.

It amalgamates the principles of their methodologies, informatics, statistics, and data analysis to study and understand actual events with information. It uses methods and theories of various other disciplines like statistics, mathematics, computer science, information technology, and several more. Just like this way, data science in banking & finance came into existence.

Usage of Data Science in Banking and Finance

Finance was one of the first industries to use data science and is now known as data science in banking & finance. Every year, businesses try to avoid bad loans or NPA. They did, however, generate a lot of data that was obtained during the first filing for loan approval. They decided to hire data scientists to help them avoid losing money.

The area of financial analysis uses statistical techniques to recognize the troubles of finance. Financial data science fuses the traditions of econometrics using the technological elements of information science. Financial details science utilizes machine learning, prescriptive and predictive analytics to offer strong opportunities for understanding financial details and solving related issues. The area is growing by bounds and leaps.

Let’s look at what can be achieved by applying data science in banking & finance:-

Customer Lifetime Value:

Customer Lifetime Value (CLV) makes it possible for the banks to evaluate the customers they have. It provides predictive value to each of the online businesses the financial institutions are going to derive throughout the lifetime of a client. It calls for a rigorous process of information cleaning and manipulation. Then there is usually profiling and segmentation before the last design could be fit to create the desired results. Data science in banking assist to predict how long and what will be the value of a customer to their business.

Customer Lifetime Value (CLV) makes it possible for the banks to evaluate the customers they have. It provides predictive value to each of the online businesses the financial institutions are going to derive throughout the lifetime of a client. It calls for a rigorous process of information cleaning and manipulation. Then there is usually profiling and segmentation before the last design could be fit to create the desired results. Data science in banking assist to predict how long and what will be the value of a customer to their business.

Customer Segmentation:

Customer Segmentation based on numerous requirements not only can certainly help create designs on the segmented information but may also in itself give insights and trends regarding consumer data, which usually is used to focus on the proper clients with the proper plans and benefits. AI Methods as K means clustering, arbitrary forest, and choice trees could be used to get significant insights.

Fraud Detection:

The banks as well as such financial institutions are actually wary about fraudulent things to do which can influence them negatively by making them incur big losses. Analytics has evolved to be a standalone branch in itself and typically involves strong regression model building & forecasting strategies. Billions of transactions take place every day and it is almost impossible to check every and each transaction and verify them but data science in banking helps it to catch fraudulent transactions.

The banks as well as such financial institutions are actually wary about fraudulent things to do which can influence them negatively by making them incur big losses. Analytics has evolved to be a standalone branch in itself and typically involves strong regression model building & forecasting strategies. Billions of transactions take place every day and it is almost impossible to check every and each transaction and verify them but data science in banking helps it to catch fraudulent transactions.

Risk Modelling:

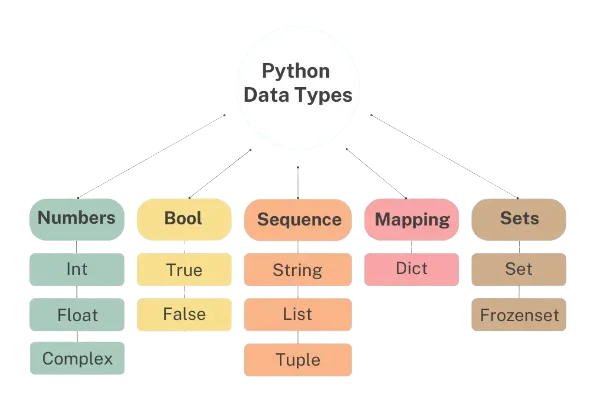

Banks along with other financial institutions have deemed danger modeling an integral and mandatory part of assessing their overall performance of theirs. Pressure assessment is actually being performed in the majority of the main banks all over the world. Data science in banking and its equipment such as SAS, Python (learn differences between Python and Java here), and R are usually used to hold out the examination on the economic wellness of the institutions.

Banks along with other financial institutions have deemed danger modeling an integral and mandatory part of assessing their overall performance of theirs. Pressure assessment is actually being performed in the majority of the main banks all over the world. Data science in banking and its equipment such as SAS, Python (learn differences between Python and Java here), and R are usually used to hold out the examination on the economic wellness of the institutions.

Customer Support:

Do you have to have got those provides via telephone banking is also a part of data science in banking and finance? And, maybe, you’ve actually opted for that life term insurance plan? Well, absolutely nothing to be concerned about. The bank has established a strong customer support program as well as, with the assistance of AI, has been in a position to monitor and investigate all the data of yours and investment patterns in an extremely effective manner. Automation byways of macros and arrays help it to determine offers and plan differently for each of its buyers.

Case Study of HDFC Bank using Data Science

Throughout 2004, HDFC Bank found India began thinking regarding investing in analytics with a goal to revolutionize the banking industry in India. They might use it to recognize exactly who was an an’ active’ buyer, that was a’ long-term’ buyer, as well as, that was simply having an account.

The offers had been sent out appropriately, so had been the add-on advantages, and these, in turn, aided them to improve the framework of theirs and, much more notably, the trust the clients had in them. In June 2014, the NPA for HDFC bank account stood at 1.1 %, one of the lowest accomplished in Indian banking.

The investment in AI as well as, particularly, ML, had obtained them abundant advantages. The outcomes were there to be noticed by everybody. Other banks have observed the results, and certainly, none may complain that investing and using information science haven’t worked out properly for these people. Through applying the concept of data science in banking, HDFC not only improved but also gained a competitive advantage.

Conclusion

When data science is actually applied to finance, data science in banking & finance, the blend helps develop processes and systems to draw out insights from financial details in different types. It’s substantially enhanced risk analysis as well as anomaly detection, top to well-known changes in the capability to identify fraudulent transactions as well as money laundering activities.